A

800 page timeless masterpiece that is the Vol II of another 800 page classic

‘The Intelligent Investor’ by Benjamin Graham & David Dodd (Warren

Buffett’s Gurus). To be honest, reading them both cover to cover can be quite a

task in itself. But the fundamentals laid out in this have stayed true through

the test of time. I may not have done complete justice to this book but have

tried to cover major concepts of investing. Below is my interpretation of the

book –

- DEFINITION: An investment operation

is one which, upon thorough analysis, promises safety of principal and a

satisfactory return. Operations not meeting these requirements are

speculative

- Market is not a ‘Weighing

Machine’ but a ‘Voting Machine’

- The ‘Speculator’

admittedly risks his money upon his guess or judgment as to the general

market or the action of a particular stock or possibly on some future

development in the company’s affairs

- 4 problems that an investor must look to attend –

- General future of

corporation profits

- Differential in Quality

between one type of company and other

- Influence of interest

rates on dividend on earnings

- Extent to which your

sales or purchases must be governed by factor of timing as distinct from

the price

- 3 functions of analysis –

- Descriptive (all facts

relevant are out across and compared with similar issues)

- Selective (specific

judgement on an issue to buy, sell, retain)

- Critical (specific

review on an issue)

- To buy an Attractive

enterprise at Unattractive terms vs an Unattractive enterprise at Attractive terms - the untrained

investor must not venture into unattractive enterprises as historically

lesser money has been lost by investing in sound businesses

- Quantitative

factors

to be considered –

- Capitalisation

- Earnings and dividends

- Assets and liabilities

- Operating statistics

- Qualitative

factors to

be considered –

- Nature of business

- Relative position in

the industry

- Management character

- Operating

characteristics

- Outlook for the

industry

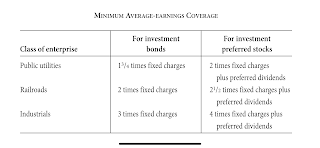

- For bonds, 3

aspects pose a dilemma –

- security of principal

and interest

- future of bond yield

and prices

- future value of dollar

- Bond selection is based on ‘Minimizing Loss’ whereas stock selection is based on ‘Maximizing Profit’

- Guarantees and Rentals must be included in the

calculation of fixed cost and evaluating coverage ratios

- There are no

permanent holdings. Have periodic reviews

- Bull

markets

are ‘Born in Pessimism’, ‘Grow in Scepticism’,

‘Mature on Optimism’ and ‘Die on Euphoria’

- This is the nature of financial services: you see a steady decline, and then you

fall off a cliff – Never hold on to any stock (whose fundamentals are

not in place) in hope – you know what I mean ;)

- The

convertible stock is not bought for conversion but must be either held or

sold.

They are bought for long term with the hope of realising gains fairly soon

- It is desired to buy the ‘Right Company’ than at the ‘Right Terms’

- Invest in

Common Stocks because of –

- Suitable and established

dividend return (now just a slight bearing)

- Stable and adequate

earning record (only to estimate future earnings)

- Backing of tangible

assets (now entirely devoid of importance)

- Check for ‘Earnings

Average’ vs ‘Earning Trend’

in common stock investment. The shift is due to instability in businesses

- The income

statement and cash flow

must converge. 3 factors for common stock –

- Dividend record

- Earning power

- Asset value

- Value of a

business = EPS * quality factor is the P&L way. But we must also consider balance

sheets as solely this is misleading. Important to take into account the non-recurrent profits and losses, operations

of subsidiaries, reserves etc

- Watch out

for –

- idle property

depreciation

- deferred payment

- loss/profit from sale

of asset

- cost stricken off

against surplus

- valuations of goodwill

and trademark should not be changed frequently,

- Analysis

of the future must be penetrating rather than prophetic

- People who habitually

purchase common stock at more than 20 times the average earning are

more likely to lose considerable

money in the long run

- Earnings power unsupported

by asset values—measured as reproduction values—will, absent special

circumstances, always be at risk

from erosion due to competition

- Learning

from balance sheet

–

- It shows how much capital

is invested in the business

- It reveals the ease or

stringency of the company’s financial condition, i.e. the working-capital

position

- It contains the details

of the capitalization structure

- It provides an

important check upon the validity of the reported earnings

- It supplies the basis

for analyzing the sources of income

- Book value

= (all tangible assets - all liabilities)/total shares

- The Current Asset

value of a stock consists of the current assets alone, minus all

liabilities and claims ahead of the issue. It excludes not only the intangible assets but the fixed and

miscellaneous assets as well

- The Cash Asset

value of a stock consists of the cash assets alone, minus all liabilities and

claims ahead of the issue. Cash

assets, other than cash itself, are defined as those directly equivalent

to and held in place of cash. They include certificates of deposit,

call loans, marketable securities at market value and cash-surrender value

of insurance policies

- Basic

rules on working capital – Ratio of 2 (current assets to current liabilities)

was standard for industry

- Raising large

debt frequently a sign of weakness - industry may be stressed if it is not for trade. Eg

Telecom in current state

- This important part of security analysis may be

considered under three aspects, viz.:

- As a check-up on the

reported earnings per share

- To determine the effect

of losses (or profits) on the financial position of the company

- To trace the

relationship between the company’s resources and its earning power over a

long period

- On Selling – sell targets must be

revised regularly to reflect all current available information. Tax consequences must be considered

Do share your views/feedback in the comments section